In today’s fast-paced world, where technology plays a crucial role in communication, email marketing has become an indispensable asset for financial advisors. This powerful medium allows for direct and personalized interaction with clients, offering a unique blend of convenience and effectiveness in a market driven by digital engagement. It’s more than just sending newsletters; it’s about forging lasting connections, educating clients, and growing your business in an increasingly competitive market.

This guide delves into the art and science of email marketing tailored for financial advisors, revealing strategies, best practices, and innovative trends to help you unlock the full potential of this powerful marketing channel.

Understanding the Importance of Email Marketing for Financial Advisors

Email marketing is an essential tool for financial advisors, offering a cost-effective way to reach and engage clients. As outlined in Forbes, for every $1 invested in email marketing, the average return on investment is an impressive $42. Consequently, this statistic highlights the remarkable efficiency and profitability of email marketing in the financial advisory sector.

Email marketing continues to be highly effective in the 2020s, with a return on investment of up to 44:1. Its power to reach customers and acquire new leads is unparalleled among digital platforms. Indeed, this effectiveness is grounded in the fact that email campaigns are valuable throughout the customer lifecycle, from acquisition to building lasting relationships.

Furthermore, according to a report from Y Charts, an impressive 90% of clients emphasize that the frequency and caliber of communication they receive from their advisors greatly influence their choice to remain with the service and recommend it to others. Additionally, more than 72% of clients express a preference for receiving advice and insights through email as opposed to other communication methods, such as phone calls. This underscores the prominent preference for email as the primary mode of client communication.

Consequently, its ability to target specific audiences is critical, allowing advisors to tailor their messages to different segments of their client base. Therefore, this targeted approach, a cornerstone of effective email marketing for financial advisors, fosters stronger client relationships, essential in the finance industry where trust and credibility are paramount.

Developing a Targeted Email List

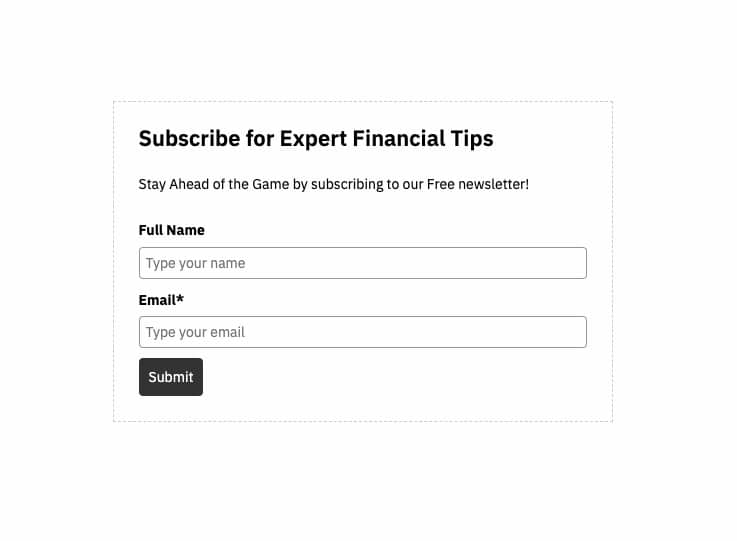

A quality email list is the backbone of successful email marketing. For financial advisors, this means acquiring emails ethically and strategically. A Salesforce report indicated that 49% of customers sign up for emails to receive special offers. Therefore, using website sign-up forms, promoting newsletter subscriptions via social media, and leveraging networking events are effective strategies. Prioritizing consent and interest ensures a list of engaged and potential clients.

The concept of a “lead magnet” holds significant importance for financial advisors aiming to build an email list. In this context, a lead magnet involves offering valuable resources tailored to financial topics, such as financial guides, investment webinars, or retirement planning tools, in exchange for individuals signing up with their email addresses.

Once a strong email list is formed, strategically segmenting it into distinct categories, such as existing clients, potential prospects, or individuals with particular financial interests or goals, greatly enhances the effectiveness of email marketing campaigns.

Once you have a lead magnet, here are ways to build an email list:

Set Up a Landing Page: Furthermore, design a dedicated landing page on your website for your lead magnet. This page should highlight the benefits of the lead magnet and include a strong call to action (CTA).

Optimize for Conversion: Additionally, the landing page should be optimized to encourage sign-ups. This includes compelling copy, attractive design, and a simple, straightforward form to capture email addresses.

Promote Your Lead Magnet: Additionally, use various channels to promote your lead magnet. Moreover, this can include social media, blog posts, guest posts on other sites, paid advertising, and partnerships with other businesses or influencers.

Email Capture Form: Furthermore, make the email capture form as simple as possible – usually just a name and email address. Lengthy forms can deter potential subscribers.

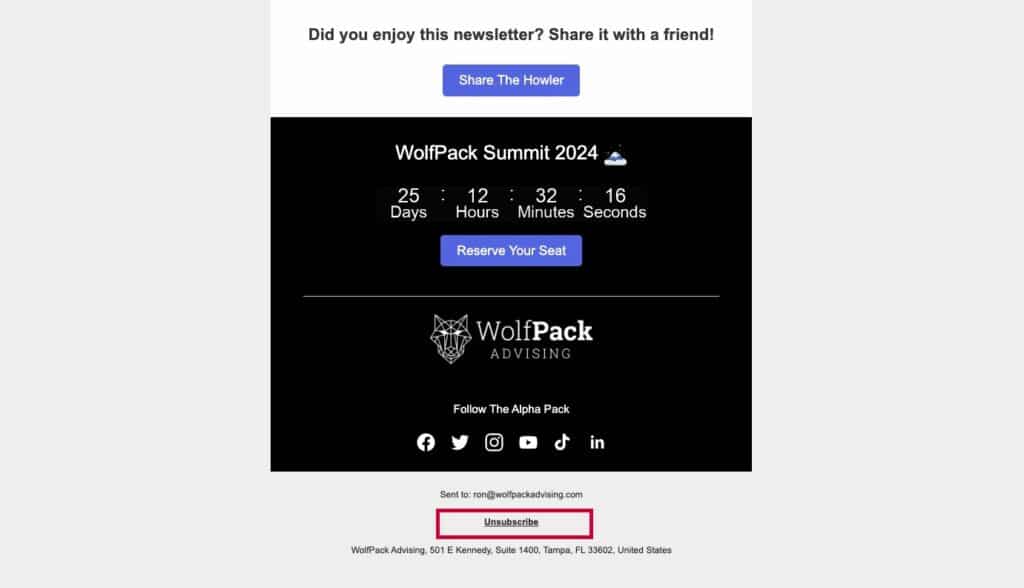

Compliance with Regulations: Ensure that your email capture process is compliant with laws like GDPR or CAN-SPAM Act, which means having clear privacy policies and consent mechanisms.

Welcome Email: Once someone signs up, send a welcome email that delivers the lead magnet and sets the tone for future communications. This email should be warm, welcoming, and reflective of your brand’s voice.

Nurture the Relationship: Don’t just stop sending the lead magnet. Develop a series of follow-up emails that provide additional value, further engaging your new subscribers and building trust.

Segment Your List: As your list grows, segment it based on subscriber interests, behaviors, or demographics to make your email campaigns more targeted and effective.

Continuously Offer Value: Additionally, keep providing valuable content through your emails. This could be in the form of insights, tips, industry news, or exclusive offers.

Retargeting Campaigns: Use retargeting ads to capture the attention of visitors who didn’t sign up initially. Show them what they are missing out on by not subscribing.

Regular Updates and Maintenance: Keep your list clean by removing inactive subscribers and updating your lead magnet and content to stay relevant and valuable.

Additionally, this segmentation allows financial advisors to target their messages precisely to address the specific financial needs and interests of each group, ultimately improving the impact of their outreach efforts.

Creating Engaging Content

The content of your emails should be informative and relevant. For example, a newsletter could include market trends, financial planning tips, and insights into economic changes. A study by HubSpot shows that personalized emails increase click-through rates by 14% and conversion rates by 10%. Therefore, delivering content that resonates with the specific needs and interests of your audience is crucial.

The content of emails should be much more than straightforward communication; it should tell a story, solve problems, or provide valuable information. This approach helps in building trust and credibility with clients. For instance, Capital Group suggests offering weekly insights on markets and economy or resources for different financial life stages, as a way to keep content relevant and engaging.

Personalization and Segmentation

Tailoring emails to specific segments of your audience can significantly enhance engagement. For instance, segmenting clients based on their investment interests – such as retirement planning or stock market investments – and sending them relevant information can lead to a 760% increase in email revenue, as highlighted by Campaign Monitor.

Segmentation Based on Investment Interests

Email segmentation is the process of dividing an email contact database into smaller groups based on specific criteria.

To illustrate how effective email segmentation can work, let’s consider the following example:

- Equity Investors: Clients interested primarily in stock market investments.

- Real Estate Investors: Clients focused on real estate investment opportunities.

- Retirement Planning: Clients seeking advice for retirement savings and pension plans.

- Young Professionals: Clients who are early in their careers, focusing on wealth-building and risk-taking investments.

- High Net Worth Individuals: Clients with significant investment capital, interested in diverse and high-value investment opportunities.

Personalization of Messages

Personalization involves using these segments or contact data to tailor messages for the intended recipients.

To understand the impact of personalization in email marketing, consider this example:

- Equity Investors:

- “Explore our latest insights on stock market trends and exclusive equity investment opportunities tailored for you.”

- Real Estate Investors:

- “Discover new real estate ventures and market analytics to maximize your property investment portfolio.”

- Retirement Planning:

- “Let’s plan your future with secure and profitable retirement plans designed to give you peace of mind.”

- Young Professionals:

- “Kickstart your investment journey with our curated high-growth portfolios, ideal for young professionals like you.”

- High Net Worth Individuals:

- “Experience bespoke financial advisory and exclusive investment opportunities suited for your high net worth status.”

In summary, personalization and segmentation are essential for creating targeted, effective email marketing campaigns. They help in reaching the right audience, maintaining email deliverability, and maximizing the return on investment. For marketers, understanding and applying these concepts effectively is key to leveraging the full potential of email marketing.

Compliance and Legal Considerations

Adhering to regulations like the CAN-SPAM Act and GDPR is crucial. Non-compliance can result in hefty fines. For example, GDPR fines can cost up to 4% of annual global turnover or €20 Million, whichever is higher.

These laws are primarily targeted at preventing spammers from acquiring people’s email addresses without permission and sending unsolicited emails. However, nuances in these laws can be accidentally violated even by well-intentioned marketers, so staying informed and compliant is crucial.

To ensure adherence to these laws and avoid inadvertent violations, marketers need to be aware of key compliance steps. Below are some crucial steps to follow:

Permission to Email: Marketers must have either implied or express permission to email people. Implied permission applies to those with whom there is an existing business relationship, while express permission is granted when someone specifically agrees to receive email campaigns, such as through a subscription form on a website.

Avoid Misleading Header Information: Email campaigns should not include incorrect or misleading information in the header, such as the “from” name, subject line, and reply-to address. This is to avoid tricking recipients into opening the emails.

Include a Valid Postal Address: Furthermore, email campaigns must include a valid postal address of the business. This can be a street address, postbox, or an address with a registered commercial mail-receiving company.

Honor Opt-Out Requests Promptly: Recipients’ opt-out requests must be honored within 10 business days, and the process should be straightforward without requiring the recipient to provide additional personal information. Subsequently, upon completing the opt-out process, recipients will be directed to a confirmation page, clearly informing them that they have been successfully unsubscribed.

Measuring Success and Analytics

Tracking metrics like open rates, click-through rates, and conversion rates is essential in evaluating the success of email campaigns. According to Mailchimp, the average open rate for finance-related emails is around 21%. Regular analysis of these metrics allows for continuous improvement of email strategies.

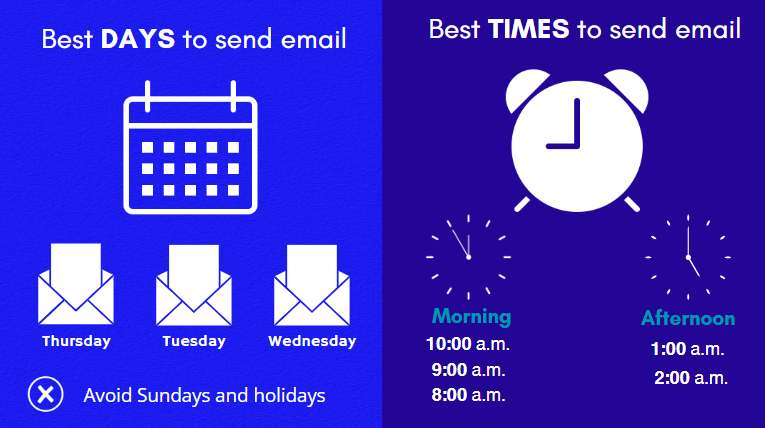

Constant testing and learning are crucial for optimizing email campaigns. Testing different versions of emails to see what resonates best with various audience segments can improve open and click-through rates. It’s also important to determine the optimal days and times for sending emails, with weekdays generally being more effective

Best Practices for Email Design and Delivery

The design and timing of emails play a significant role in their effectiveness. A clean, professional layout with a compelling subject line can increase open rates. Additionally, CoSchedule’s research suggests that emails sent on weekdays, particularly Tuesdays, have higher open rates.

Integrating Email with Other Marketing Efforts

Email marketing should be part of a broader marketing strategy. Integrating it with social media campaigns, content marketing, and traditional advertising creates a cohesive and comprehensive marketing approach.

Integrating email marketing with other marketing efforts is a strategy that has become increasingly important in today’s business landscape, particularly through the concept of omnichannel marketing. Here are key insights on this topic:

Omnichannel Marketing: This approach involves using all communication channels to reach customers, providing a seamless and integrated customer experience across various platforms. Whether it’s through online platforms, mobile apps, social media, or physical stores, omnichannel marketing creates a cohesive brand experience. It is considered essential for all businesses in the digital age.

Marketing Automation Significance: Marketing automation has become vital in today’s business environment. It streamlines marketing efforts, personalizes communications, and optimizes strategies. Automation tools provide insights into customer behavior and engagement, enabling data-driven decisions. This approach is crucial for nurturing leads throughout the customer journey by capturing and analyzing data at each touchpoint, thus creating personalized and targeted messaging.

CRM Integration: Integrating CRM with email marketing, lead nurturing, and lead scoring offers a comprehensive view of customer interactions. CRM systems store vital customer data, including email communication history and purchase history, which enhances collaboration between sales and marketing teams. Consequently, this integrated approach leads to meaningful customer conversations, personalized recommendations, and exceptional customer experiences, optimizing the customer journey for lasting success.

Diverse Integration Applications: WolfPack Advising supports a wide range of integration applications, including accounting apps, analytics, CMS, CRM apps, databases, developer tools, documents, e-commerce, education, event management, form apps, HR, lead generation, messaging, payment, project management, sales, scheduling, social media, and storage apps. Moreover, these integrations enhance various aspects of business operations, from managing accounting and analytics to improving sales processes and customer support.

Conclusion

As the digital landscape evolves, so does the importance of effective email marketing for financial advisors. By understanding the best practices, legal requirements, and emerging trends, advisors can harness the power of email to enhance client relationships and drive business growth.

Wolfpack Advising offers expert advice and tailored solutions for those seeking to refine their email marketing strategy. Contact Wolfpack Advising today to elevate your email marketing campaigns and stay ahead in the competitive world of financial advising.